Home > autobiz insights > autobizInsights #15

autobizInsights #15

Is this really the end of diesel?

Towards more stability?

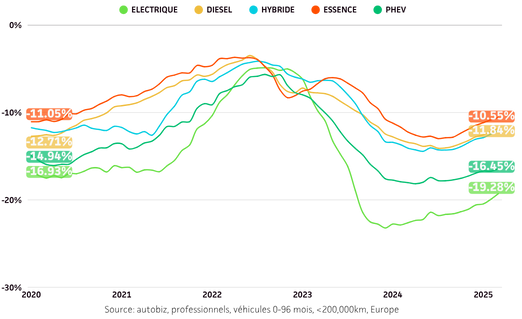

The latest Used Car (UC) market developments in Europe are showing signs of improved stability, especially if we compare the first half of 2025 to both 2023 and 2024: observed depreciation rates are decreasing and are now getting closer to pre-covid rates, at least for some energies.

New dynamics

Behind this apparent stability, we observe new dynamics when it comes to pricing and stock management. Rather steady in the past years, the UC market is now constantly evolving with many pricing parameters that need to be considered.

In such context, we believe that close monitoring is an absolute necessity.

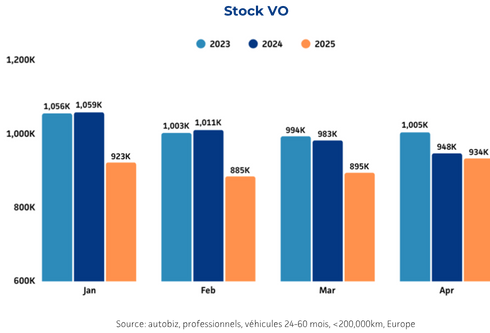

A lack of core UC products

In Europe, in the first quarter of 2025, we have observed a decrease in volume of traditional off-lease vehicles, aged between 24 and 60 months. This is a direct effect of the global chip shortage affecting the new car production between 2020 and 2023.

Not only are the volumes lower than the previous years, but the stock mix is also different with more electrified vehicles, especially BEV cars now representing 10% of the stocks vs 7% in 2023.

The BEV dilemma

Whilst OEMs are strongly promoting BEVs, in a context of strengthened CAFE constraints with government incentives still very high in most of the EU countries, used BEVs are struggling to find new owners.

The annual depreciation rates observed by autobiz show that we are back to pre-covid levels, except for PHEV and BEV cars.

Even though BEV cars are in a better position than last year, the depreciation rates are still much higher than ICE cars, apart from Nordic countries.

In some countries like France or Italy, the situation of PHEVs also raises some alerts with depreciation rates close to those of BEV cars.

Is diesel sexy again?

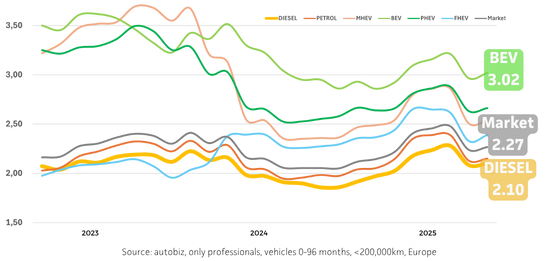

Despite strong governmental policies and diesel-bashing since the VW dieselgate scandal in 2015, this fuel type remains resilient and has the lowest liquidity in Europe with only 2.1 months of sales in stock.

In the Nordic countries, the average vehicle stock duration is slightly longer, around 3 months in April, compared to an average of 2.1 months. However, this remains relatively short overall.

There are some discrepancies between the countries, in France and in the UK, for example, diesels are more attractive than in Spain or Germany.

How to navigate through these new dynamics?

Since the beginning of 2022, we have witnessed a steady increase in the volume of pricing and repricing activity in the market, with up to two times what was observed in April 2025 compared to January 2022.

Prices change more frequently, but they also change less. In 2023, average price drops of 500 euros were observed in contrast to a recent average of below 100 euros per car.

Considering these new parameters, professionals need to closely monitor the market, as well as having the right tools and the right data to offer the most accurate, frequently-updated prices to maximise their profitability.

Jordan Pageot, Customer finance and RV manager