Home > autobiz insights > autobizInsights #18

autobizInsights #18

Why does remarketing stall during defleet peaks?

Every remarketing professional knows this scenario: thousands of vehicles coming back from lease or fleet contracts, all at once, all needing to be appraised, valued, refurbished, and resold. This is the reality of defleet peaks. What looks like a routine process in quieter months suddenly turns into a bottleneck that strains teams, slows down remarketing, and inflates costs.

The critical role of appraisal and valuation

At the end of a contract, no car can be remarketed without going through two essential steps:

- A physical appraisal to identify damages, wear and tear, and refurbishment needs.

- A valuation to determine the right price for resale.

These steps are the foundation of trust between all parties involved — lessor, fleet manager, dealer, and final buyer. Yet they come at a cost: on average, an appraisal takes around 30 minutes per car. Add to that multiple validation loops between inspectors, pricing specialists, and managers, and what should be a smooth workflow quickly becomes a slow and complex process.

When seasonal peaks push the system to its limits

In normal times, 30 minutes would be manageable. Inspectors and pricing experts can work steadily, refurbishments follow, and cars return to market without major delays.

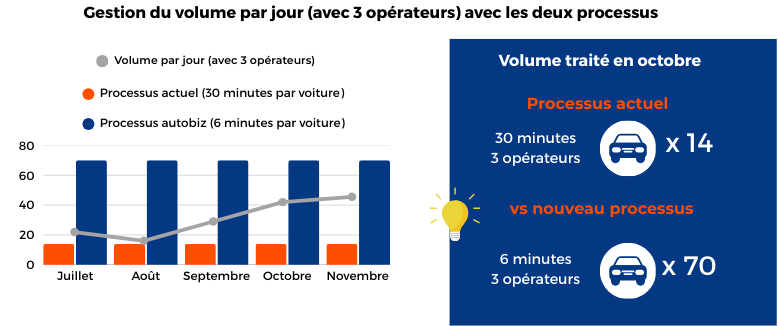

But during seasonal peaks, typically at the end of a fiscal quarter or year, volumes surge. Suddenly, instead of handling a steady flow, remarketing teams are faced with hundreds of cars per day. Under normal circumstances, regarding the standard process, three operators are sufficient enough to handle the daily volumes, but increased volumes generate operational problems.

The impact is immediate:

- Queues build up: vehicles wait days before appraisal.

- Bottlenecks multiply: each validation step delays the next.

- Remarketing slows down: cars sit idle, depreciating in value.

In an industry where time literally equals money, these delays weigh heavily on margins.

With the new process, however, we see that even during peak periods, the targets are more than met. We can even go further: this performance significantly reduces vehicle stock levels, allowing cars to be remarketed much faster.

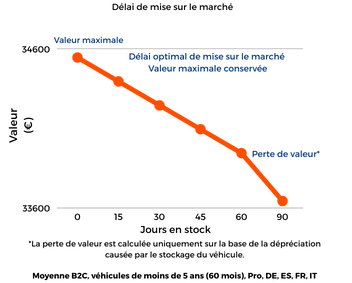

The hidden cost: Refurbishment under pressure

Remarketing delays don’t just affect timing; they erode vehicle value. Every extra day a car spends in stock means accelerated depreciation and higher financial holding costs. When large volumes of vehicles hit the market at once, remarketing teams face bottlenecks, and cars linger longer before resale. For fleet operators and lessors, this translates into shrinking margins, as vehicles lose value before they even reach buyers. For remarketing teams, it means managing a backlog of depreciating assets instead of running efficient, predictable workflows. Reducing time-to-market is therefore essential to protect resale values and overall profitability.

A structural challenge, not just a seasonal one

Defleet peaks may only happen a few times a year, but their impact is long-lasting. They create frustration for every stakeholder: Fleet owners face delayed cashflow.

Workshops experience fluctuating workloads, ranging from underutilisation to overload.

Appraisers and pricing managers face mounting pressure, which increases the risk of errors.

For years, the industry has adapted by using temporary reinforcements, overtime or manual prioritisation, but these are short-term fixes that don’t address the structural issue: appraisals and valuations are still too slow and too dependent on manual effort.

In the next part of this series, we’ll explore how AI is already transforming car appraisals and valuations. We’ll unpack how it is helping remarketing teams to save time, reduce bottlenecks, and regain efficiency even during periods of high vehicle disposal.

Chloé Diebold, Project Manager – Digital Customer Success